closed end fund liquidity risk

A number of funds have earned 4- and 5-star ratings. Our funds have star power.

Ad Explore funds and choose those that align with your clients goals.

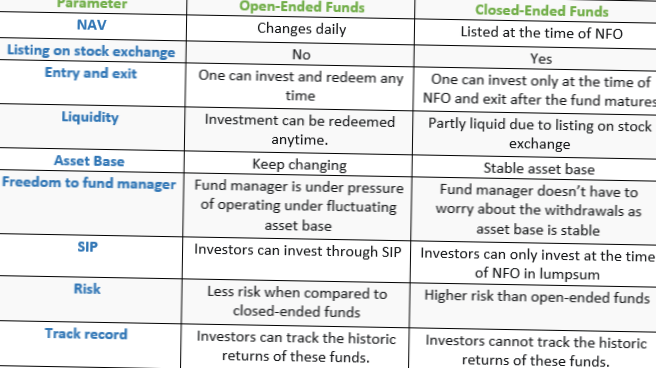

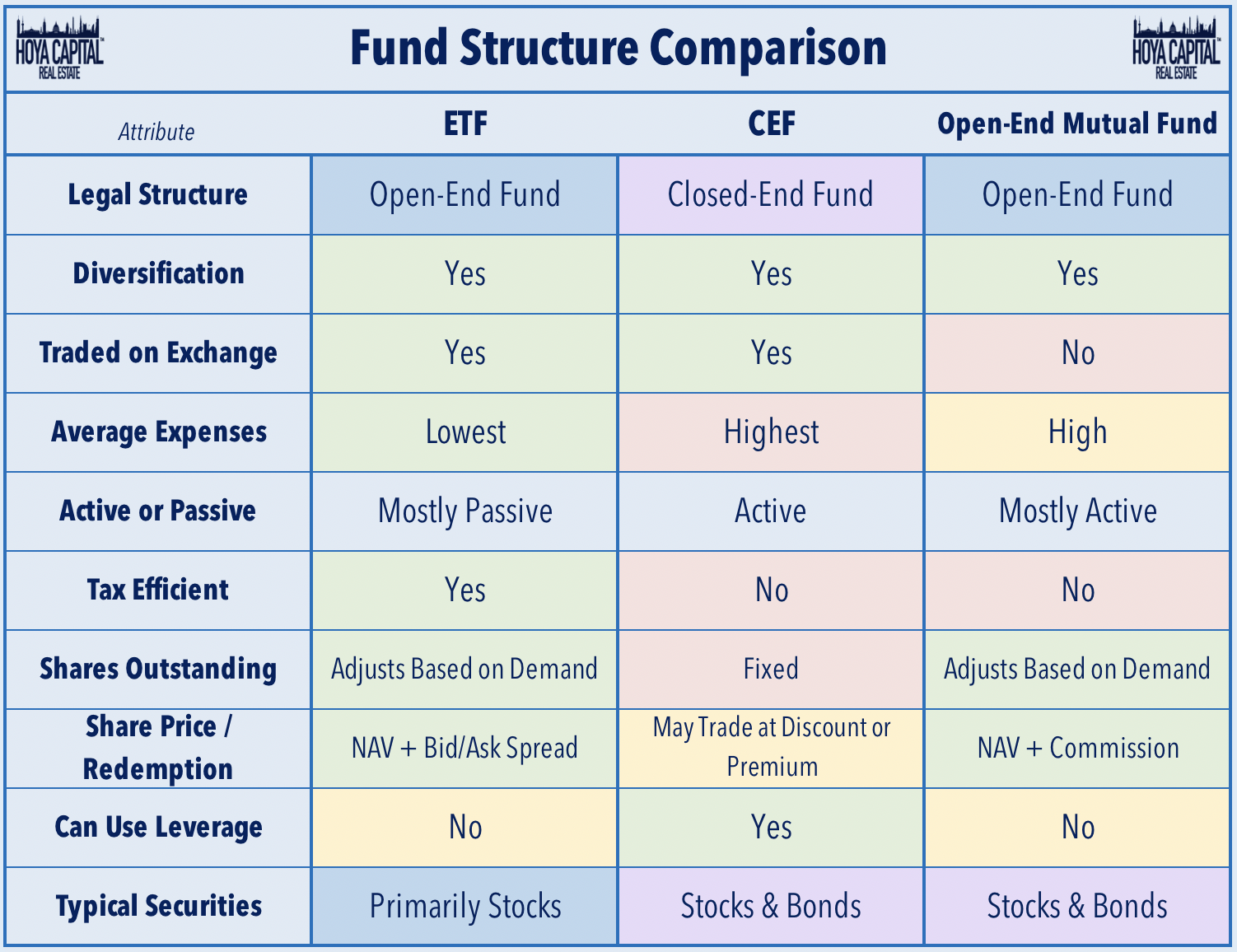

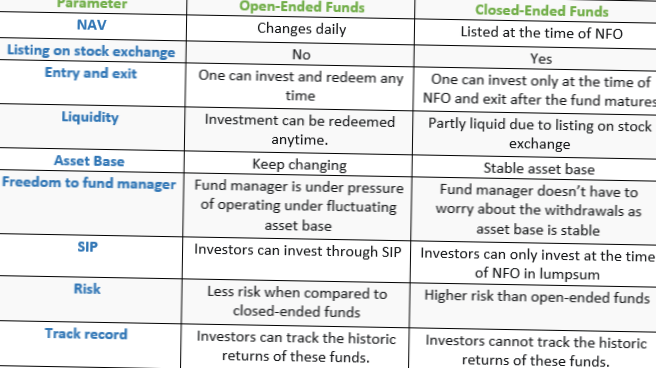

. Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds. Closed-end funds raise a certain amount of money. There is a one-time initial public offering IPO and with limited.

Closed-end funds can offer advisers opportunities to introduce clients to successful portfolio managers and strategies at a discount when prices fall. Demand and supply of a closed-end mutual fund can be driven by market sentiment the reputation of the fund manager poor return-and-risk profile high management. Closed-end funds by contrast are not continuously offered and have a fixed number of shares outstanding.

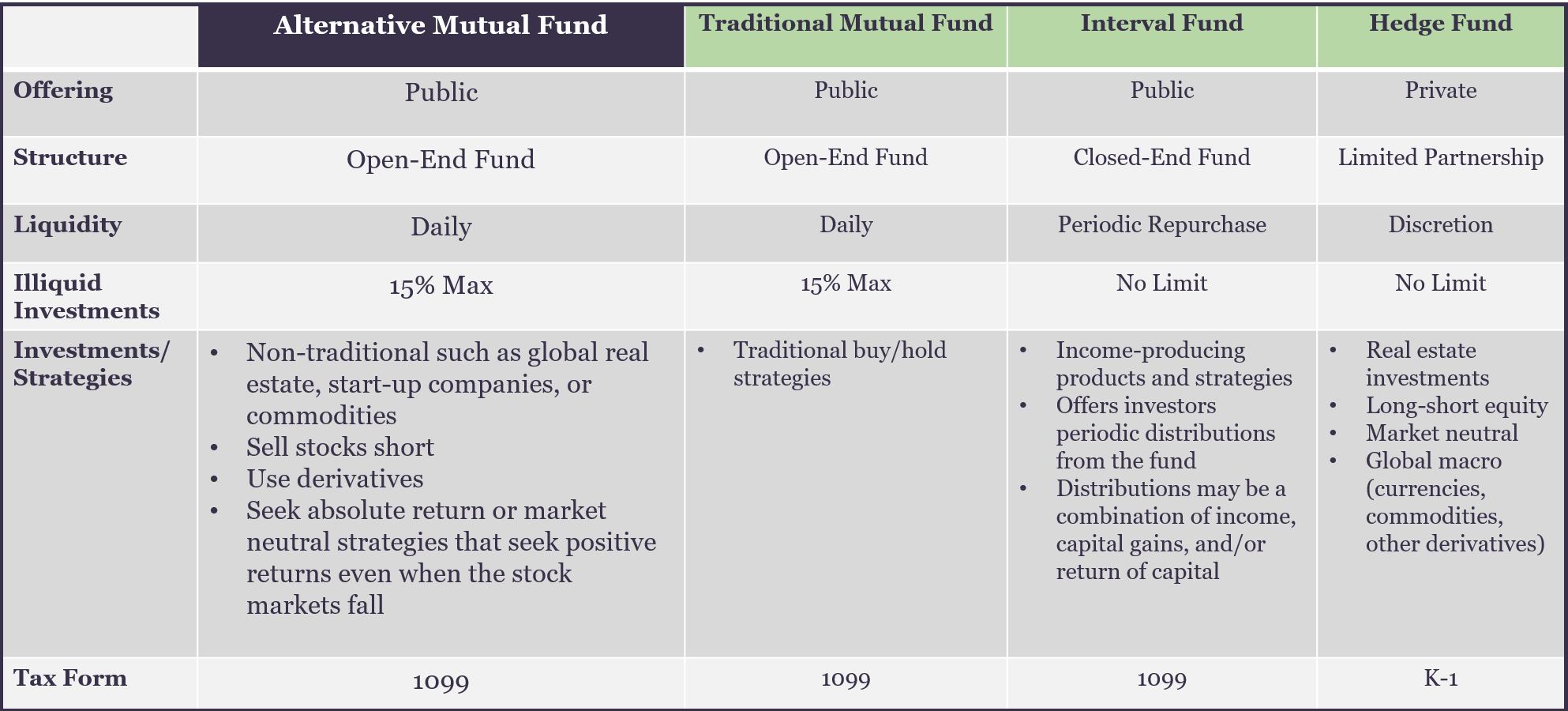

Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often on a small. Ad Low-Risk High-Dividing Closed-End Funds. Closed-end funds are considered a riskier choice because most use leverage.

Liquidity risk is defined as the risk that a fund could not meet. Ad Reduced single fund risk with a portfolio of CEFs managed by top fixed-income managers. Funds are required to assess manage and periodically review their liquidity risk based on specified factors.

Investment policies management fees and other matters of interest. A closed-end fund or CEF is an investment company that is managed by an investment firm. Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often on a small.

Diversified by asset strategy manager. Ii consistent with the theory. Additionally while a money market fund is an open-end management investment company money market funds are not subject to the rules and amendments we are adopting except.

Closed-end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund. Free List10 Best Closed-End Funds. The use of leverage by a closed-end fund can.

In this case the closed-end fund sells at a discount of 2 per share. The value of a CEF can decrease due to movements in the overall financial markets. Closed-end funds are investment vehicles that bear a passing resemblance to mutual funds and exchange-traded funds ETFs.

On a percentage basis the fund sells at a discount. This is a significant risk for closed end. The majority of closed-end funds specialize in illiquid securities such as municipal corporate and international bonds while CEFs are themselves relatively liquid.

Closed-end fund definition. Furthermore early investors in noncore closed-end funds are subject to blind pool risk 6 so prospective clients need to evaluate a managers skills and prior track record. Just like open-ended funds closed-end funds are subject to market movements and volatility.

The use of leverage allows a closed-end fund to raise additional capital which it can use to purchase more assets for its portfolio. That is they invest using borrowed money in order to multiply their potential returns. High Dividend Stock Specialists.

Credit Risk Credit risk is the risk that the issuer of a security will default or unable to meet its obligations to pay interest or principal as scheduled. Closed-end funds may trade above or below the funds net asset value based on supply and demand for the funds shares and other technical factors. All three fund types are pooled.

If you invested five grand a year and got just a 6 annual return youd have over 490000 at the end of 35 years on a fund with a 08 expense ratio. Lets assume that the market price is 18 per share and that NAV is 20. Any day when theres a 1 move in a CEF can be thought of as a day when there is a supply and demand imbalance outside of ex-dividend days and large moves in interest.

If you instead paid a 23.

Closed End Fund Definition Examples How It Works

Investing In Closed End Funds Nuveen

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Tourshabana What Are Closed End Vs Open End Mutual Funds Compare 4 Key Differences In Investing

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

What Is The Difference Between Closed And Open Ended Funds Quora

Reassessing Investment And Liquidity Risks Kpmg Global

Open Ended Mutual Funds Meaning Benefits Open Vs Close Ended Funds

What Are Mutual Funds 365 Financial Analyst

Alternative Mutual Fund Liquidity Spectrum Investment Comparison

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Difference Between Open Ended And Closed Ended Mutual Funds Differbetween

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer

What Is The Difference Between Closed And Open Ended Funds Quora